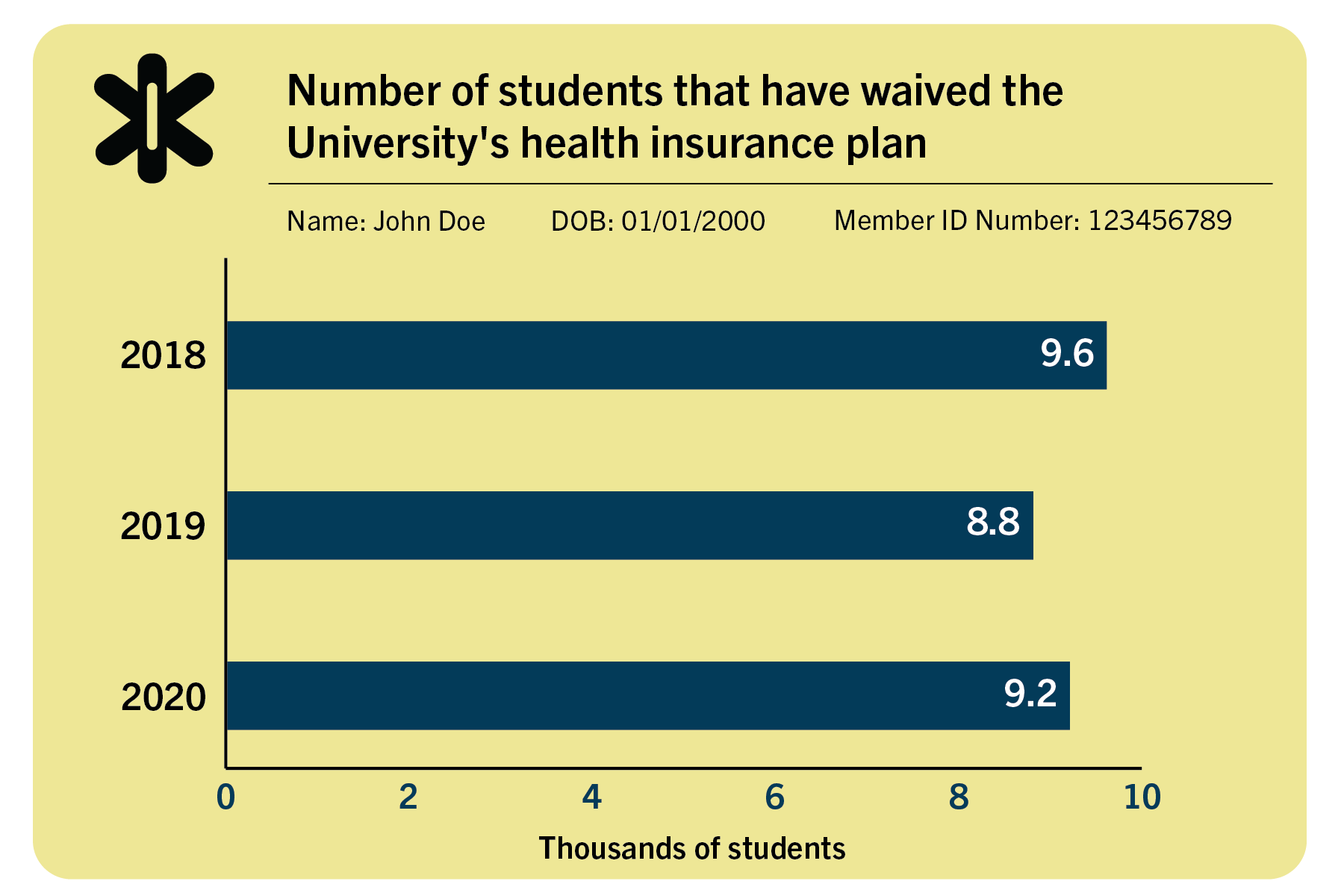

Enrollment in GW’s student health insurance plan dropped slightly this academic year as most students took classes off campus for the semester.

University spokesperson Crystal Nosal said 9,278 students waived the comprehensive Aetna student health plan compared to about 8,800 students last fall, an increase of about 5 percent this year and slight drop from 2018. Nosal said this year’s data is not a “one-to-one” comparison to last year because online classes have changed some students’ means of accessing health insurance.

“As an example, international students who are required to have a domestic-based insurance plan while living in the United States were able to opt out of the Aetna insurance and continue with their country-based insurance provider if they remained in their home country while taking classes this fall virtually,” she said in an email.

The Colonial Health Center automatically enrolls all undergraduate, medical, on-campus nursing, health science and international students holding a J1 or F1 visa in the University’s health insurance plan, according to the CHC website. Students can waive the University health plan if their individual or family coverage fulfills GW’s requirements, the website states.

Officials implemented a mandatory insurance policy in 2018 to reduce the overall cost of student health insurance and make the program more accessible for students.

Students who chose to waive the University plan this fall after enrolling last year said the combination of virtual telehealth options available through their home insurance and a lack of trust in the CHC’s services prompted them to opt out.

Sidney Lee | Graphics Editor

Junior Liora Ami said she waived the student plan after two years of enrollment because she can access telehealth options outside of the CHC. She said she previously enrolled in the University’s plan because she lived in D.C. and could easily access the health center in person.

Ami said using her family’s insurance also appealed to her because she can see the same doctor each time instead of meeting with a different CHC staff member with each visit.

“I didn’t really have a doctor I could go to my freshman and sophomore year, but now that it’s mainly transitioned online, the level of care that I get from my other doctors is much better and it’s much more convenient,” Ami said.

More than a dozen students said last fall that they experienced poor quality of care and long wait times at the CHC, which led them to receive delayed prescriptions and left them unable to access mental health resources.

Junior Caroline McGinnis said she has chosen the University plan the past two years because her family’s plan was not accepted in D.C., but she’s since switched to her family’s plan because it offers telehealth options.

“I would have re-enrolled in it if life was normal because even though it was really slow, it was really convenient to get testing for infections really quickly,” McGinnis said.

Health insurance experts said enrollment in the health care plan may have dropped because students’ home health insurance is more accessible while they are away from campus.

Linda Bergthold, a former senior consultant at the consulting company Watson Wyatt Worldwide, said living in close proximity to an on-campus health clinic is an “advantage” of a university plan, but students can’t reap the same benefits while they’re home.

“One of the benefits of a university plan usually means there’s an on site clinic of some kind, where you can just go,” she said. “It’s convenient when you’re living on campus.”

Bergthold said all students must be on an insurance plan, whether it be a university or individual plan, to ensure they’re covered if they contract a virus like COVID-19. She said students should consider the costs of an individual and university plan if they are no longer on a family plan because a standalone plan can be expensive.

Aetna offers student plans for $2,180 annually for mandatory enrollment and $3,330 annually for voluntary enrollment, according to Aetna’s benefits summary for GW students.

“It’s not like a year ago when your biggest concern might have been being in a car accident or getting an STD,” Bergthold said. “Now, it’s living or dying.”

Charles Gaba – the founder of ACASignups.net, which tracks enrollment in the Affordable Care Act – said students should typically choose a health care plan with as wide a network of care providers as possible when deciding between plans. He said students are likely choosing plans this year that are closer to where they reside, which is likely why GW health care insurance enrollment dipped.

“The D.C. network doesn’t do any good if you’re in Michigan if you get sick or injured,” Gabs said.