Yonah Bromberg Gaber | Graphics Editor

Source: National Association of College and University Business Officers

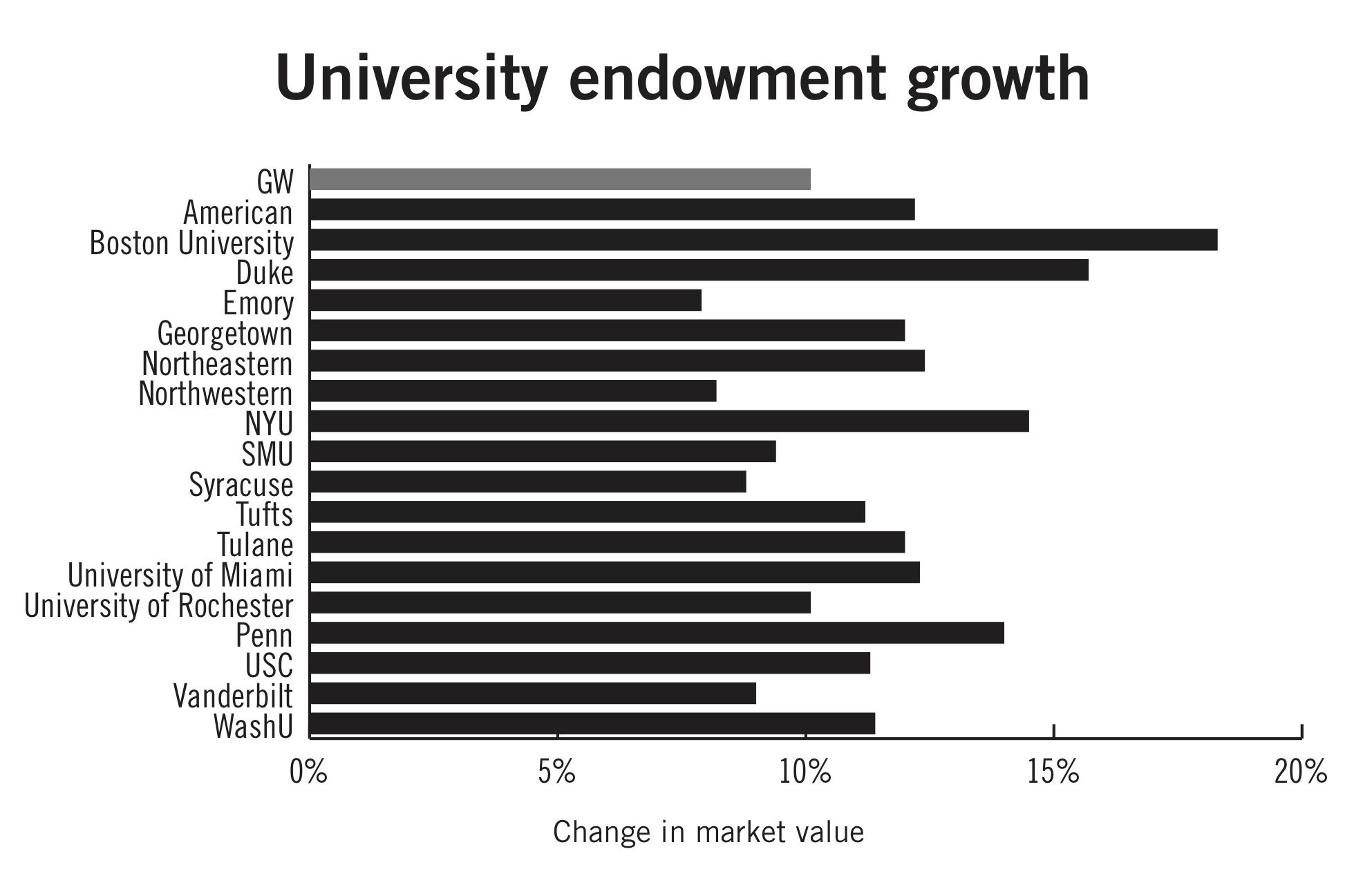

GW’s financial foundation grew last fiscal year – along with all of its peers – but the pace of growth lagged behind most competitors.

GW and its peers schools increased their endowments by 11.6 percent on average, but GW’s gains were slower than two-thirds of schools in its market basket and slightly behind the national average of 12.2 percent, according to a new report from the National Association of College and University Business Officers. Experts said university endowments rose nearly across the board last year because of the strong performance of the stock market.

The University’s endowment – a financial bedrock that funds professorships, scholarships, construction projects and other University activities – grew about 10 percent in fiscal year 2017. Investments rebounded from a rocky 2016 when the endowment dipped by $50 million.

In an analysis of 818 colleges and universities, NACUBO found that endowments overall reversed last year’s downtown, growing 12.2 percent after a 1.9 percent average decrease. Despite last year’s decline at GW, the University performed better than the national average in 2016.

Last fiscal year, endowments at 12 of 18 peer schools outpaced GW’s growth.

Ann McCorvey, the deputy executive vice president and treasurer, said endowment spending was about 5 percent last fiscal year – the same as 2016. Investment returns surged 12.8 percent, McCorvey said, reversing a downturn in 2016 when net value fell $13 million.

McCorvey said the growth of the endowment came mostly from U.S. and global investments, but GW’s real estate holdings, which have long been a major part of its financial strategy, are still performing “well.”

The growth of the endowment will not mean that more money will be available from the fund to bankroll University projects in the short term, she added.

“We also look at endowment growth over longer periods of time – typically three, five and 10 years – to determine if payout amounts are appropriate,” she said in an email. “New gifts to the endowment would generate additional payout.”

She declined to say why GW’s endowment growth might have been slower than most of its peer schools. McCorvey said she expects the endowment’s performance will remain solid going forward, but declined to say why.

Kenneth Redd, the senior director of research and policy analysis at NACUBO, agreed that the endowment increase nationwide was mainly due to simultaneous economic growth in the U.S and world markets. The U.S. stock market had a consistently strong performance last year, breaking several records.

The endowment’s growth comes from donations and investments, which are dependent on the success of financial markets, Redd said.

“As long as the financial markets are doing well and donors remain generous to their universities, then in general endowments will do well,” Redd said.

Although this year’s national endowment growth is encouraging, Redd said the increases need to persist over several years to have a significant impact. He said universities still haven’t fully rebounded from the 2008 recession when university endowments plummeted.

Redd added that he and others at NACUBO are “concerned” about future endowments, after Republicans in Congress passed a sweeping tax overhaul in December, which includes more regulations on charitable tax deductions. He said those deductions could limit incentives to donate to universities, hampering endowment growth.

Joseph Cordes, a professor of economics and chair of the Faculty Senate’s fiscal planning and budgeting committee, said because real estate markets are doing well, universities like GW, which invest large amounts of money in real estate development, saw their endowments grow.

“I think all of the evidence is that GW has developed considerable expertise in developing properties that it owns and developing them in a way that’s good for the university,” Cordes said.

In 2016, the University announced plans to develop Rice Hall and its property at 2100 Pennsylvania Ave. into a retail and commercial office space by 2019. GW is the second-largest landowner in downtown D.C., behind the federal government.

Cordes said GW’s $1 billion fundraising campaign likely didn’t have a major effect on the 2017 endowment because many of the gifts are not ready to be immediately spent. The $1 billion campaign met its goal a year ahead of schedule last May.

Frederick Joutz, a professor of economics, said GW’s increase was likely slower than peers’ and the national average because of the University’s relatively low alumni giving rate – which is about 9 percent – and its inability to reel in large donations.

The University attracted its largest gift ever in 2014 – an $80 million donation to the Milken Institute School of Public Health – but officials have not announced any large donations in the last several months.

“You can have 10,000 people give you $100 a year, but you need the person who gives you a $10 million gift,” Joutz said. “For some reason GW hasn’t had that high rate and really hasn’t had that big whale, and maybe it’s coming, you never know.”