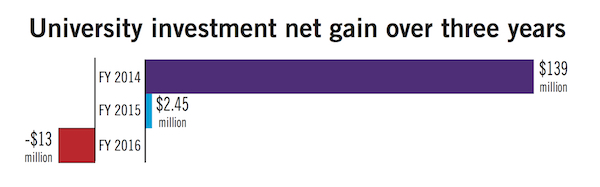

The University experienced a net loss of $13 million in its investments last fiscal year, after two years with positive investment income, according to recently released financial statements.

Experts say the loss puts GW on pace with many universities around the country that are also struggling to deal with the slow economic growth of financial markets. But because GW has placed its investments into different types of funds instead of concentrating them in one area, those experts said the University is taking the right steps to minimize losses.

Gains on investments were small during fiscal year 2015 with only $2.45 million in returns, down from when the University saw a net gain of $139 million on investments in fiscal year 2014.

This past fiscal year, GW’s financial foundation, which is made up of its total assets, real estate holdings and investments, went down nearly three percent from the year before and now totals $1.57 billion.

University spokeswoman Maralee Csellar said the University’s endowment actually gained 1.2 percent, but its market value decreased during the fiscal year because of spending to support financial aid and the University’s operating budget.

William Jarvis, the executive director of Commonfund, a nonprofit asset management firm, said a loss of this size on the GW’s investments should not spark much concern over the University’s financial health.

“If I look at an endowment that’s $1.6 or $2 billion, to have total losses across all of those categories of $13 million is really relatively negligible,” Jarvis said.

Jarvis said during fiscal year 2014, when GW had nine-figure returns, investment returns rocketed nationwide, but almost no universities are expecting to see double digit returns on investments in the next few years.

“This is an environment in which it’s a struggle to create growth, and without growth it’s a struggle to achieve robust investment returns without taking unacceptable levels of risk,” Jarvis said. “The question for endowment investment managers is what levels of risk are acceptable.”

Jennifer Delaney, an associate professor of higher education at the University of Illinois at Urbana-Champaign, said universities’ financial strategists try to invest in many different areas to minimize the impacts of sudden market changes.

GW made $83 million in investments from property rents this year, an 18 percent decrease from last year. The University uses its large number of real estate holdings as one of the main ways to diversify its portfolio – GW is the second-largest landholder in D.C., after the federal government.

The University invests in a variety of funds, including hedge funds, corporate debt, government debt, real estate and asset-backed securities. Strategic Investment Group, the Arlington-based firm that has managed GW’s endowment since 2014, has historically declined to provide details about where exactly the University’s investments are.

Delaney said funneling money into riskier or short-term investments to diversify the portfolio is a way to minimize losses in the future.

“If there’s a big decline in hedge funds but an increase in real estate prices, they can balance each other,” Delaney said.

Lorna Scott, the director of risk and operations at the University of Illinois Foundation, said diversifying the kinds of investments an institution holds is a way to reduce risk when global economic patterns are unpredictable. Endowment managers use diversification as a way to lose less when financial markets perform poorly – meaning that when an area an institution has invested a great deal of funds in suddenly tanks, it isn’t left clinging to financial livelihood.

“By diversifying your investments you will get different returns that will react differently in different markets,” Scott said.

Ryan Williams, a professor of finance at the University of Arizona, said diversifying an investment portfolio internationally can combat swings in the market.

The University invested about $338 million total in Central America, the Caribbean, South Asia and East Asia and the Pacific in fiscal year 2015, according to tax documents.

“A lot of big investors such as universities tend to be diversified internationally as well, as long as their charter doesn’t prohibit this,” Williams said. “You usually kind of smooth out these big market movements the more you diversify.”

He added that just by looking at the national investment returns, he would not recommend that universities change their investment strategies. GW’s loss was “not out of whack” compared to market performance overall, he said.

“I couldn’t say that this was a negative just because it wasn’t a very good year in markets,” Williams said.

Avery Anapol contributed reporting.