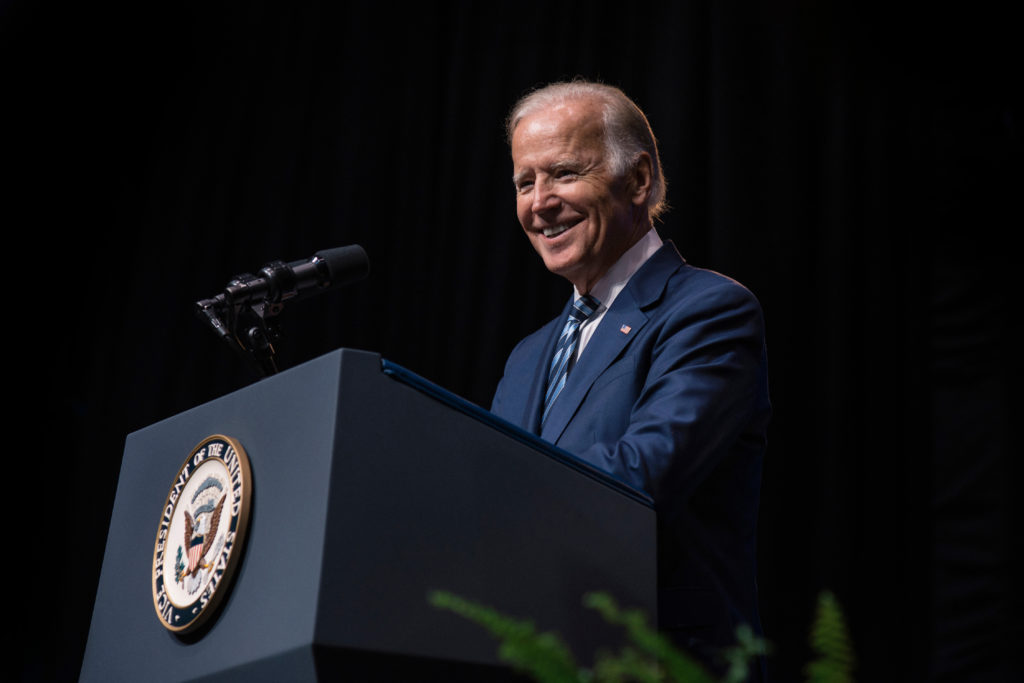

President Biden announced that the federal government would cancel $10,000 in student debt for borrowers who make less than $125,000 a year Wednesday.

The loan forgiveness also applies to couples and families who bring in less than $250,000 a year, will include up to $20,000 in debt relief for Pell Grant recipients and is estimated to ease the financial burden for millions of Americans. Biden said he will also extend the moratorium on student loan payments – which was set to expire on Sept. 1 – for the final time and push the deadline four months to Dec. 31.

“In keeping with my campaign promise, my administration is announcing a plan to give working and middle-class families breathing room as they prepare to resume federal student loan payments in January 2023,” Biden said in a tweet Wednesday afternoon.

Almost 90 percent of the benefits will go to borrowers who make less than $75,000 a year, according to federal data. The plan would apply to about 43 million borrowers and would wipe out the remaining balance of about 20 million borrowers, according to a White House release.

“Getting an education should set us free; not strap us down!” Secretary of Education Miguel Cardona said in a release. “That’s why, since Day One, the Biden-Harris administration has worked to fix broken federal student aid programs and deliver unprecedented relief to borrowers,”

The move could add around $120 billion to the government’s total costs, according to experts in higher education.

The Department of Education will set up an application process for borrowers to claim their debt relief by the end of the calendar year, but about 8 million borrowers will automatically receive their relief because their financial information is already available to federal officials, Biden said.