The Medical Faculty Associates’ net assets dropped by about 200 percent during the last six years, according to a report on the MFA’s operations at a Faculty Senate meeting Friday.

The MFA’s net assets have plummeted from about $70 million in Fiscal Year 2016 to about negative $80 million in FY 2021, according to a report that the Faculty Senate’s fiscal planning and budgeting committee delivered on the MFA’s financial well-being Friday. The MFA is a financially independent organization connected to the University through a network of doctors in the D.C. area who teach students in the School of Medicine and Health Sciences.

Joe Cordes and Susan Kulp, faculty senators and co-chairs of the fiscal planning and budgeting committee, said in the report that GW’s loans to the MFA include a $50 million line of credit – money that could otherwise cover costs for opportunities to strengthen the shared services IT system at GW and deferred maintenance, the process in which officials implement facilities and maintenance updates that are most affordable and top priorities for the University.

GW offers the MFA loans, forgives some of its debt to the University and holds contractual relationships with the MFA through faculty who teach at SMHS, the report states.

“If you look at the data, it never really was very profitable, but it didn’t sort of lose money the way it has, which as we’ve said, is partly pandemic and other kinds of related,” Cordes said.

Kulp said the University “guarantees” the external debt of the MFA – which means the University would accumulate the MFA’s debt – which is at $165 million as of June 2021.

“In theory, the MFA could make contributions to the University if it were profitable,” Cordes said.

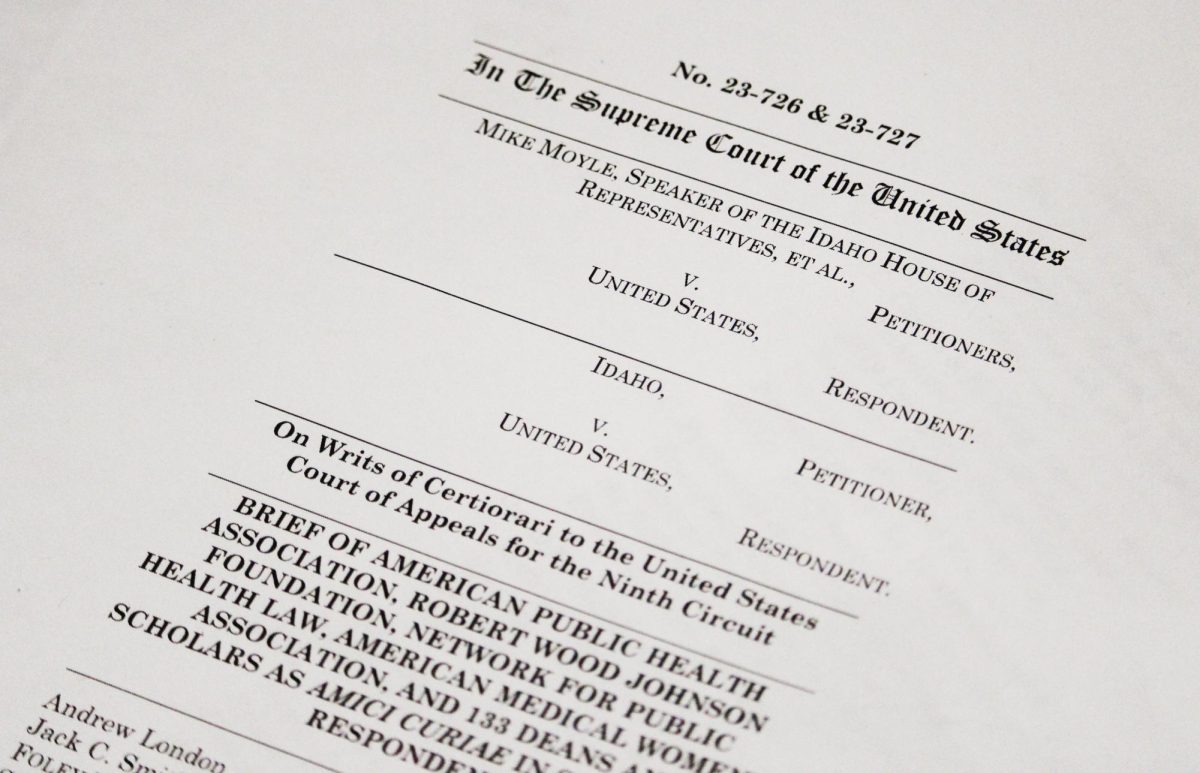

[gwh_image id=”1165101″ credit=”Fiscal Planning & Budgeting Committee’s Medical Faculty Associates Financial Structure Report” align=”none” size=”embedded-img”][/gwh_image]

Kulp said the MFA currently has a negative net worth as the organization’s liabilities exceed its assets by roughly $79 million in the 2021 fiscal year. The report states that the MFA has a more than $40 million deficit, with its expenses consistently higher than revenue since 2019.

Barbara Bass, the CEO of the MFA and the dean of the School of Medicine and Health Sciences, said at the meeting Friday that GW is not sending any “active funds” to the MFA, and she proposed a new model of GW’s medical enterprise in which the medical school would house the MFA through a closer partnership with GW Hospital. Bass said GW would work to increase the academic healthcare enterprise’s rank and profitability and better align with the “people with the money” through this restructured system.

“I think there’s absolutely no reason we should not be highly successful, not only from the research and educational perspective, but clinical performance, financial entity in this organization and in this city,” Bass said.

Bass was not present at the meeting during the report from Cordes and Kulp detailing the MFA’s financial standing and loss of assets.

Diaz said in 2019 that the University forgave a $20 million loan to the MFA in 2016 after the organization spent three times its revenue in 2015 and 2016 and needed “some bailing out.”

Officials restructured the MFA in 2018 to financially stabilize the organization after it went through “fiscal turbulence,” taking more control over the previously-independent nonprofit organization.

“We got to remedy the fundamental structural flaw first and that is the relationship with the University Hospital,” Bass said.

Cordes said the University’s ability to exert control over the MFA is “prudent” because the University is held liable for decisions the MFA makes. If the MFA were to file for bankruptcy, then the University would have to pay back the organization’s borrowed debts.

Bass said officials do not have plans for the MFA to walk away from its debt to the University.

Faculty senators said they appreciated the transparency from the reports at the meeting but were still concerned about the financial future of the MFA.

Anthony Yezer, a professor of economics and a faculty senator, said from a business perspective the MFA’s finance numbers are troubling.

“You need a business model and you need revenue and cost forecasts, what have you, and I haven’t seen any of that,” he said. “And, gosh, we’re not well managed, but this is bad.”

Eric Grynaviski, an associate professor of political science and international affairs and a faculty senator, said he’s unsure on how the MFA plans to move forward if they are continually in debt and if the University will continue to write off the money it gives to the MFA.

“It feels like there’s still some things which are fundamentally missing from our understanding about the economics of the medical enterprise,” Grynaviski said.

Caitlin Kitson, Daniel Patrick Galgano, Ianne Salvosa, Isha Trivedi, Nick Pasion and Zach Blackburn contributed reporting.