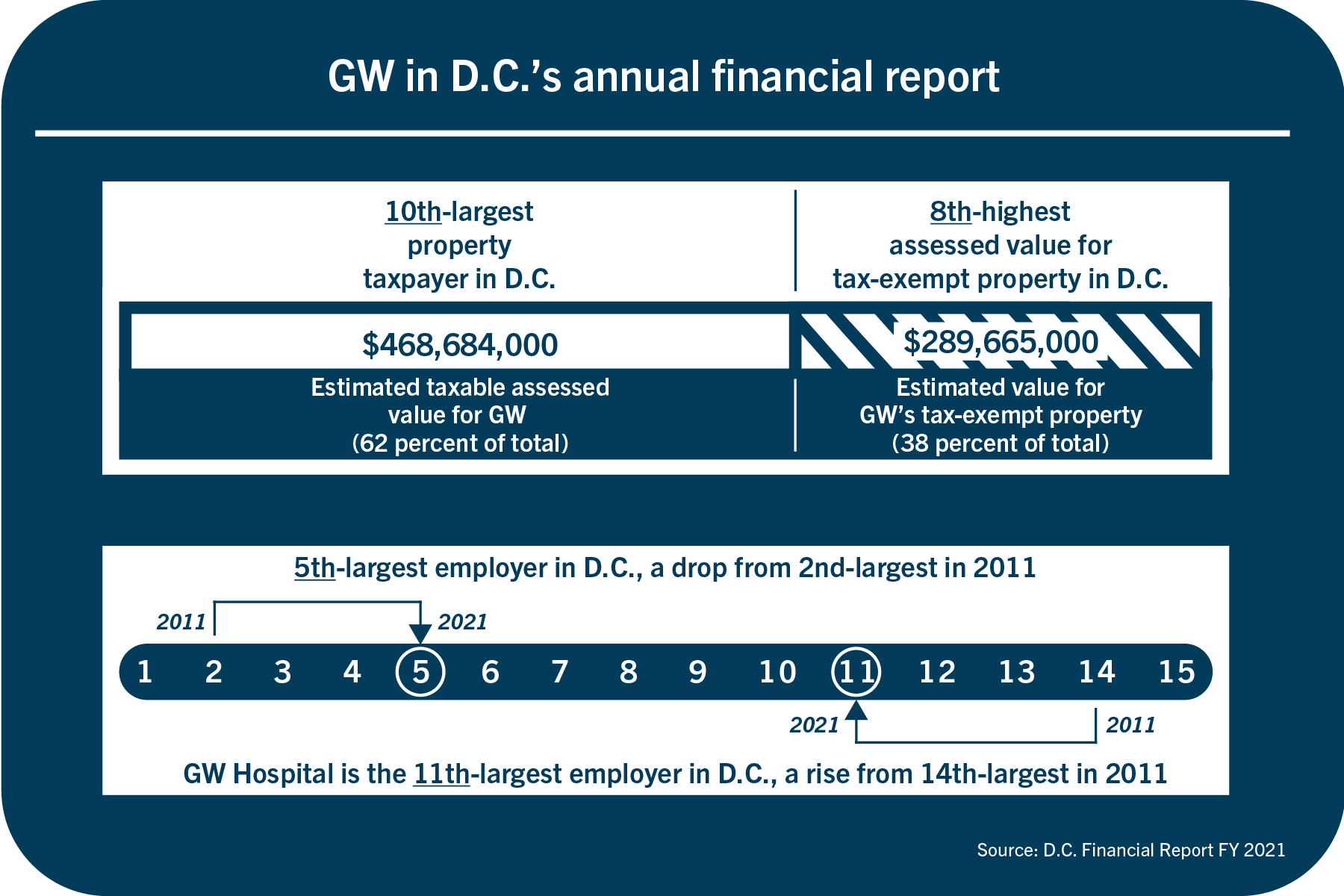

The University is among the top 10 property taxpayers, employers and tax-exempt property owners in the District, according to the city’s Annual Comprehensive Financial Report released late last month.

GW ranks as the District’s 10th-largest property taxpayer, hires the fifth most employees and owns the eighth-most valuable tax-exempt property, the report states. Experts in real estate and finance said the rankings demonstrate the University’s role as a job-creator and investor in the District, where GW owns more than $468 million in taxable property and almost $290 million in tax-exempt property, according to the report.

Steven Teitelbaum, a professor of real estate and finance at American University, said a building’s size and the value of its location determine a landowner’s property tax rates. He says the University’s vicinity to downtown D.C. raises its property value and city tax payments each year.

“The three most important words in real estate: location, location, location,” Teitelbaum said. “You happen to have a great location in terms of property values, and you happen to have a significant amount of property in that location.”

University spokesperson Crystal Nosal did not return a request for comment.

GW’s ranking among D.C. taxpayers dropped one spot since last year, but the University’s taxable property value increased from $460 million in 2020 to $468 million in 2021.

Jefferson McGough | Designer

GW is the only D.C. university that the District reported among its top 10 taxpayers, with the other nine spots filled by limited liability real estate companies and the Washington Metropolitan Area Transit Authority. GW leases many buildings to commercial vendors as part of the University’s investment strategy.

Mayor Muriel Bowser said the report reveals the District’s “strong financial position,” citing a healthy surplus of cash remaining in the city’s reserve funds, a marker used to determine financial health. Bowser said this flexibility allowed the city to expand its public health efforts to combat the COVID-19 pandemic and improve school and workplace conditions.

“The District’s finances continue to be the envy of, and among the strongest of, any jurisdiction in the nation,” Bowser said in the report.

Teitelbaum said GW earned its spot on the list of top taxpayers because of the University’s dozens of investment properties connected to its endowment assets, which are liable to District taxes as noneducational property. The University pays the most taxes on the commercial properties at 2200 Pennsylvania Ave., 2112 Pennsylvania Ave. and 2221 I St., which amount to more than $10 million in taxes annually and house the Residences on the Avenue apartments, Whole Foods, an international law firm and several businesses.

“Depending on how much you own and where it is in terms of dollars gets you on that list,” Teitelbaum said. “It’s not a list based on square footage or acreage. It’s a list based on dollar value. So anybody who is Downtown is necessarily going to have a very high value for the purposes of that list.”

The University pays taxes to the District for commercial buildings, including more than $63,000 for Tonic and more than $570,000 for the One Washington Circle Hotel in 2021. GW is partially taxed for buildings that serve educational and commercial purposes, like the University Student Center, which contains study spaces and food vendors.

The University does not pay taxes for academic buildings, like the Science and Engineering Hall and the School of Media and Public Affairs.

Catholic and Howard universities own about $130 million more in tax-exempt properties than GW, according to the report.

Teitelbaum said the District offers tax exemptions to institutions with services that will help boost economic activity, like universities whose students interact with surrounding businesses as active consumers. The University owns more than 70 tax-exempt educational properties that are worth about $1.7 billion dollars, according to D.C. data.

“You give the University the tax exemption, and it contributes value in terms of bringing people to town who help move the world forward and hopefully the local economy forward,” Teitelbaum said.

The report states that the GW Hospital has climbed three spots to 11th among the District’s top employers since 2011 when it was the 14th-largest employer in D.C. Since 2011, the University has dropped from the second-largest employer in the city to the fifth, with three of the city’s hospitals passing GW in the rankings.

Richard Auxier, a senior policy associate at the Urban Institute and Brookings Institution Tax Policy Center, said the University and GW Hospital are ranked as top employers because hospitals and universities are “anchor institutions” that require numbers of employees and create economic activity.

“They’re giant employers, so a lot of people work there, so therefore, a lot of people have jobs and upper-lots of jobs,” Auxier said. “There are professors and doctors, but there’s also the person who works the front desk. There’s the janitorial staff. There’s a whole range of people who are being employed by here.”

Auxier said universities that are top employers are beneficial to a city’s economy because of their economic independence and their resilience through irregular economic activity. He said these factors helped these institutions survive the pandemic while the city’s economy faltered.

“One of the reasons why cities really like universities is because they sometimes are not affected by these ups and downs in the overall economy,” Auxier said. “Of course they are, but the sharp declines they sometimes can weather because they have other resources or other streams of income or other activities, so it’s not completely correlated with the other ups and downs of the economy.”