This story is part of The Hatchet’s semester-long project sharing stories of GW’s faculty members at the forefront of researching the COVID-19 pandemic.

Two professors are teaming up to assess how the COVID-19 pandemic has affected the number of investments made to affect social change.

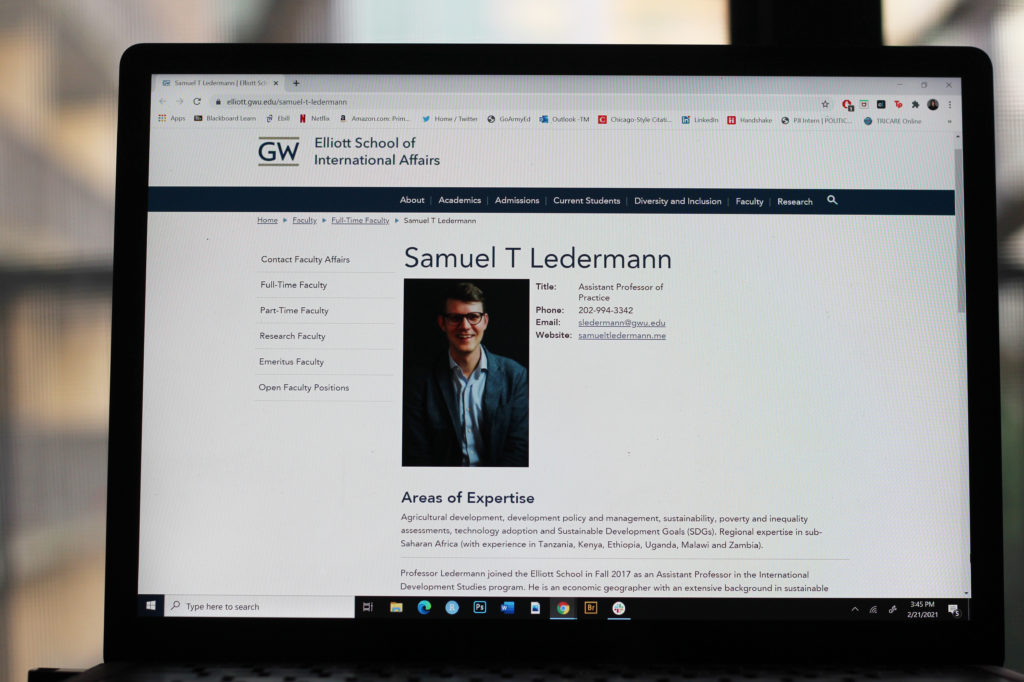

Samuel Ledermann, an assistant professor of practice at the Elliott School of International Affairs, said he spent the past two and a half months creating a survey to understand how the COVID-19 pandemic has affected the number of impact investments made to create long-term social or environmental change. He said the pandemic has created an increased need for investments in social and environmental causes but has produced an economic environment in which making such investments can be financially risky.

“The fear would be with COVID, you obviously not only have an increase in inequalities and an increase in marginalization and so forth but actually that investors are retreating because of the risks that exist to the economy,” Ledermann said.

He said the survey will be conducted globally and sent to investors, investment advisers and other researchers in the field by late March or early April, and he expects to be able to analyze results in April.

Ledermann said these investments help provide private sector funding to aid the public sector in achieving social and environmental goals, like the 17 sustainable development goals set by the United Nations in 2015.

He said he hopes he can present his research to federal and international policymakers, which could help government leaders offer a “safety net” to incentivize people to make impact investments.

“If we identify that impact investors are retreating in a specific region because of a perceived higher risk of the investments defaulting so they would lose money on them, there are instruments that exist currently where a government can say, ‘I take the first loss if an investment were to default,’” he said.

Ledermann said he received an impact grant in 2015 through his work at Biovision Foundation for Ecological Development, an organization that works to find sustainable ways to improve life for people in Africa. He said he was working to implement an agriculture technology project throughout eastern and southern Africa, which sparked an interest in sustainable agriculture and partially motivated him to start his current project.

He said impact investments have been one of the fastest-growing classes of investments globally in the 15 years, and he wanted to understand their impact with COVID-19.

“Overall, we are looking at what is happening with the investments overall right across everything, but then we are honing down and trying to understand what is the impact on the level of health and at a level of food security,” he said.

Reid Click, an associate professor of international business and international affairs who is working with Ledermann on the research, said the project will investigate whether impact investors are shifting from investments in agriculture to those in health care. He said other qualitative studies and surveys have shown that impact investments as a whole have been resilient throughout the pandemic.

A June survey administered by the Global Impact Investing Network on the pandemic’s effect on impact investing reported that the pandemic has not made a significant dent in investments.

“I am curious to know what happens during this pandemic to impact investing as a whole investment class, as well as maybe what happens to our agricultural investments, if everybody is shifting toward health care investments, so that is what the project is really about,” Click said.

Click said he and Ledermann plan to send the survey out to about 300 self-identified impact investors and organizations and will then ask those investors for names of other possible respondents. He said this number will be able to provide a sample for the investing field.

Click said the survey will ask participants questions about how the pandemic has affected their investments and their social impact.

“We also think that there will be a shift – the first shift was a shift that we worried would shift resources out of agriculture and into health care – but we also think that there will be a shift that the investments in the future will be different, even if they are in agriculture,” he said. “The new investments whether in agriculture or health care are more likely to have bigger social impacts than the older investments.”

Jake Schwartz, a first-year graduate student working on the project, said his role as a research assistant is to contribute to the literature review and write a summary of all of the research completed to date on impact investing during the pandemic.

Schwartz said he also helped develop the survey, which is sent through an anonymous link by email to investors, organizations that conduct impact investing research, policymakers and advisers to impact investors.

“We are especially curious if the positive social impacts of impact investing have increased during this time because there has been a strain, say to the health care sectors or the agriculture sectors,” he said. “And so if that is the case, I think that would be a pretty big finding that impact investing is working in creating desired social impacts.”