The University logged a roughly 70 percent decrease in net investment income as scholarships grew by about 5 percent, according to financial disclosures.

Net income from the University’s investments dropped by about 72 percent while revenue from GW’s real estate holdings increased by about 3 percent last year, according to documents detailing GW’s financial statements during fiscal year 2019, which ran from July 1, 2018 through June 30, 2019. Officials said the decline in investment income is a common fluctuation that does not exceed expectations for investment income.

University Controller Sharon Heinle, who oversees GW’s accounting records and financial reporting, said the annual decrease in net investment income used in non-operating activities last year from about $140 million to about $39 million is attributable to natural changes in the value of GW’s investments.

“Significant variations can and often do occur from one year to the next due to relative market performance of the assets in each of those years,” she said.

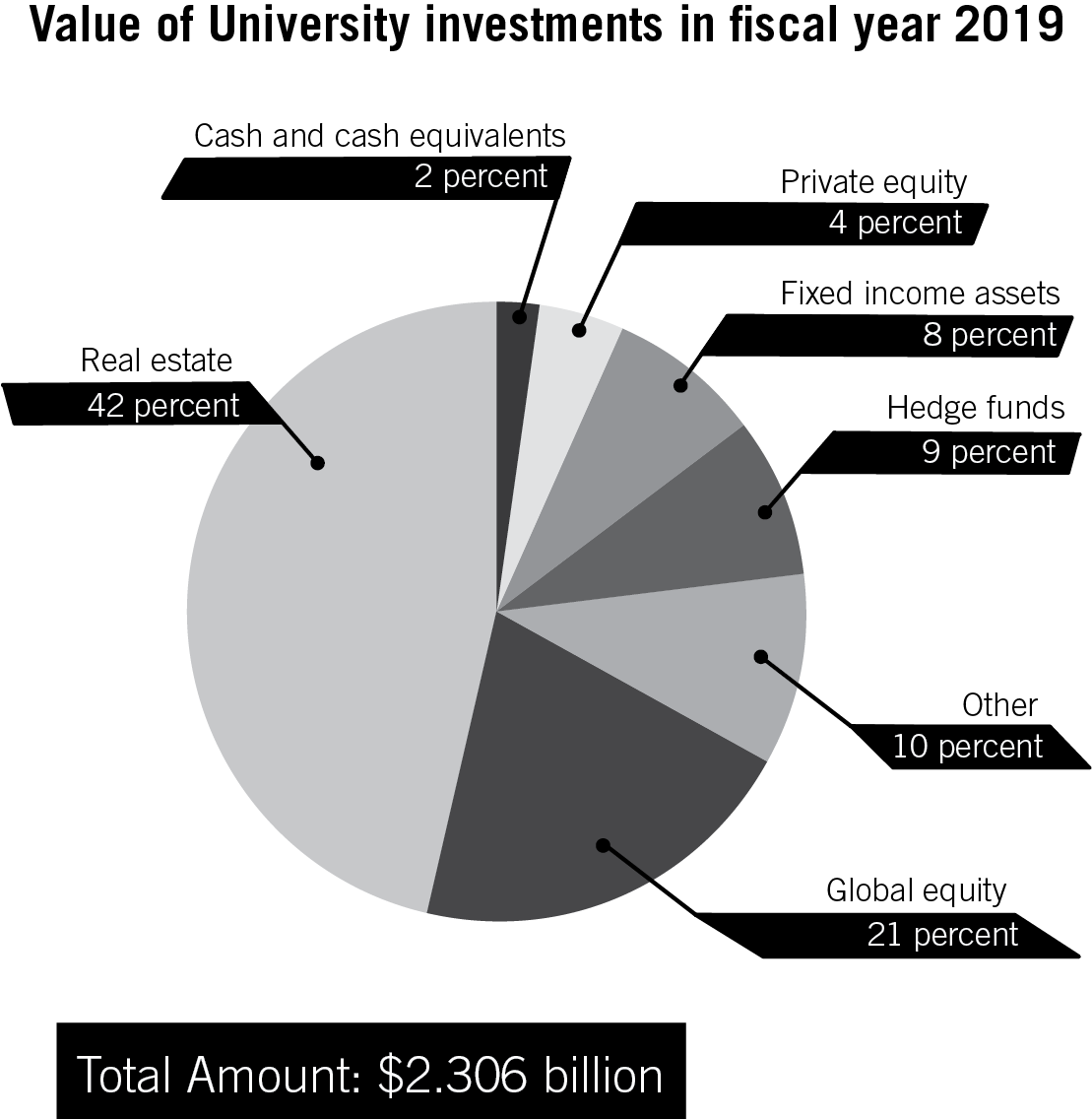

Alyssa Ilaria | Graphics Editor

Source: GW’s fiscal year 2019 financial statements finance report

The report states that the University’s endowment decreased by about $20 million in fiscal year 2019 relative to the year before, from nearly $1.8 billion to $1.78 billion.

Heinle said the total value of the endowment decreased because officials tapped into the fund in excess of the endowment’s return on investment and donations to the fund. GW’s endowment notched the lowest growth rate of its peer institutions for the second consecutive year last year.

“The slight decrease is due to payout drawn from the endowment exceeding investment return and new gifts/additions to the endowment,” she said in an email.

Officials increased “University-funded scholarships” by about 5.3 percent, reaching about $333.8 million in fiscal year 2019, according to the report. Heinle said the figure includes all need- and merit-based aid toward tuition from a “variety” of sources, including the endowment and grants, but does not include work-study wages.

The value of GW’s real estate investments grew approximately 3 percent during the fiscal year, increasing from about $1.03 billion to about $1.06 billion, according to the report. The figure includes the value of GW’s 28.56 percent stake in the Columbia Plaza Apartments, located at 2400 Virginia Ave., which was valued at $23 million at the end of fiscal year 2019, according to the document.

Heinle said the roughly $30 million increase was the result of “combined market value appreciation” during the year.

“Cash flow from real estate investments contribute to the payout from the University’s endowment to support academic priorities, including financial aid and academic programs,” she said.

The value of GW’s land holdings reached about $198.5 million in fiscal year 2019, an increase of about 10.5 percent from the previous year, while the value of GW’s buildings hit about $2.29 billion, an annual increase of about 5.2 percent from the previous year, according to the report.

The report also states that the value of GW’s “library and historical research materials” decreased from $69.5 million to $63.9 million during the fiscal year. Heinle said the drop is the result of depreciation in the value of the University’s historical documents that exceeded the value GW created through purchasing new books, which she said has decreased recently as officials increasingly rely on digital collections instead of physical materials.

GW’s libraries have faced budget struggles in recent years largely resulting from the switch to an opt-in library gift system in 2018 and the rising costs of journal subscriptions.

The report confirmed that officials forgave a nearly $20 million loan to the Medical Faculty Associates – an independent network of doctors practicing in the D.C. area who teach students in the School of Medicine and Health Sciences – in March, after officials restructured GW’s relationship with the MFA to obtain greater control over the body. The MFA’s net assets increased by about $8.8 million in fiscal year 2019 as a result of the debt forgiveness, the report states.

Heinle added that officials are still developing the full finance report and will replace the financial statements currently available on GW’s website with the report once it is complete.

“Each year we post the ‘financial statements’ as soon as the audit report is accepted by the Board of Trustees,” she said. “The fiscal year 2019 annual report is still in development – once it is finalized and approved, the annual report will be posted in place of the ‘financial statements’ version.”

Joseph Cordes, a professor of economics and the chair of the Faculty Senate’s fiscal planning and budgeting committee, said the drop in the endowment’s growth likely reflected the stock market’s adjustments earlier this year after the S&P 500, a stock market index, plunged 11 percent last December.

“Endowments last year did not exactly distinguish themselves,” he said. “We’re in good company or bad company, depending on how you look at it.”

Cordes said the decrease in investment income is normal for an institution like GW. Officials are in the process of rebalancing GW’s investment portfolio after receiving advice from debt accrediting agencies, he said.