Officials will spend tens of millions of dollars on large capital projects in fiscal year 2020 while planning for reduced enrollment and increased STEM investment in the future.

The University’s revenues and expenses approached $1.2 billion last fiscal year after a record-high freshman class enrolled two years ago, according to a presentation from the Faculty Senate committee on fiscal planning and budgeting Friday. Officials said the budget funds several major facilities and construction projects and includes new line items to account for a slight reduction in expenses.

University President Thomas LeBlanc said at the meeting that future budget considerations focus on the University’s plans for reducing enrollment by about 20 percent and achieving excellence in the four pillars underlying GW’s next strategic plan.

The University’s strategic enrollment initiatives call for an increase in the share of science, technology, engineering and math majors from 20 to 30 percent of the undergraduate student body, according to the report.

LeBlanc – who arrived at GW two years ago with the goal of prioritizing STEM research – said boosting the proportion of STEM students will add value to the University because the demand for STEM degrees is growing.

“There is a national demographic trend for STEM, especially for first-generation students because there’s a direct connection between a major and a job,” he said at the meeting.

Alyssa Ilaria | Graphics Editor

Source: Faculty Senate Fiscal Planning and Budgeting Committee report

Operating budget

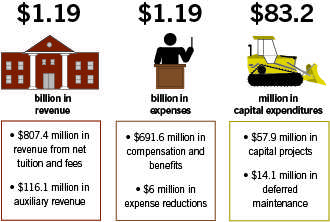

The University generated about $1.2 billion in revenue this fiscal year, nearly the same as the previous fiscal year, according to the presentation. Officials estimate the University will incur about $5 million less in expenditures – along with $6 million in expense reductions – leaving a 0.9 percent operating margin.

Officials plan to earn more than $800 million from net tuition and fees, nearly $30 million more than last year. Funding from the University’s endowment and income from housing are expected to bring in more than $200 million combined, according to the report.

Administrators plan to spend nearly $40 million more on salaries and benefits in fiscal year 2020, a 3.7 percent increase from the previous year, according to the report.

As of March 31, 2019, the University’s external debt hit $1.87 billion, about the same size as the school’s endowment as of fiscal year 2018, according to the presentation. GW’s outstanding debt, excluding endowment debt, reached $1.6 billion last fiscal year, the presentation states.

Joseph Cordes, a professor of economics and the chair of the fiscal planning and budgeting committee, said the University’s plan to reduce enrollment by 20 percent over the next five years will increase reliance on graduate tuition revenues, a more volatile revenue stream.

The University’s finances took a hit in 2014 when graduate enrollment unexpectedly took a dip, resulting in a $20 million deficit. Officials announced five years of budget cuts to boost financial health in 2015.

Cordes said that before cutting budgets, he expects officials to find other ways to close the gap in revenues caused by the enrollment decrease, like larger endowment payouts.

The presentation included Cordes’ unofficial financial estimates to model how the reduction in enrollment will affect the University’s revenues. The model states that GW will experience a $9.2 million revenue gap in academic year 2020-21 after enrollment reduces and officials transition to a floating tuition model. The gap will grow to $37.5 million by academic year 2023-24, according to the report.

Cordes said the University could also consider reducing the tuition discount rate – the average discount given to students off of the sticker price of tuition – for non-STEM students from the current average of about 40 percent to 35 percent.

But Cordes said to meet the University’s goal of increasing its STEM student ratio, officials may have to boost the tuition discount rate for STEM students higher than about 51 percent – where it currently lies – to compete with more attractive institutions. The average tuition discount rate for all majors landed at about 42.3 percent in fiscal year 2019.

Cordes added that STEM students generally need specialized facilities, which come with a hefty price tag. The Science and Engineering Hall, completed in 2014, cost GW $275 million.

“Unlike an econ major – where you need a whiteboard and marker – you need more to educate undergrad STEM majors,” he said.

Capital budget

Officials plan to spend $41 million this fiscal year for projects that cost more than $3.5 million, a 76 percent increase from the previous year, according to the presentation. Projects include an overhaul of renovations to Thurston and other residence halls and ongoing construction on the Corcoran School of the Arts and Design’s Flagg Building.

The fiscal year 2020 budget calls for $83.2 million across all capital projects, including deferred maintenance for facilities and information technology projects, according to the presentation. The projects will be funded through a combination of about $35.8 million in cash and $47.4 million in debt.

The fiscal year 2020 capital budget is about 20 percent of GW’s five-year, $424.2 million capital plan.

Cordes highlighted a few additional sources of revenue for the University, like the partial sale of patent rights to a new drug developed by GW researchers for a lump sum of $20 million and revenues from the 2100 Penn construction project, which he estimated would amount to about $9 million annually.

Cordes said the University may earn revenue from the acquisition of a new building on H Street next to the School of Media and Public Affairs that was formerly owned by the Hospital for Sick Children Foundation for $23 million.

LeBlanc said the new sources of money would be employed alongside some cost-saving measures to maintain financial stability.

Officials will shell out about $14.1 million for deferred maintenance on facilities and IT projects, a new line item on the budget that is intended to demonstrate more openness in the budget process, Cordes said.

Budget transparency and best practices

Cordes added that the fiscal year 2020 budget includes an adjustment for depreciation, a common practice in corporate accounting, and $2 million allocated for contingency funding, which he said would gradually ratchet up over time.

Officials announced last May that they would build up the University’s reserve funds to protect against any financial hardships to come. LeBlanc said in December that Moody’s, a credit rating agency, recommended that the University diversify its assets to build up its reserves in its annual assessment of GW’s financial health.

Cordes said officials are implementing measures to bring the University’s budget closer in line with best practices for accounting by including line items for future expenses and strategizing for contingencies.

He said officials included a line item for the University’s strategic initiatives this year that has not appeared in previous budgets. Although officials have not allocated any money under the item, Cordes said including a space on the budget for the initiatives will keep administrators accountable for achieving their goals.

Officials have pulled back on funding for strategic goals in the past. Administrators cut $8.2 million from the strategic plan in 2014 because of revenue shortfalls.

“If you’re going forward with the strategic plan, you ought to incorporate it into your budget,” he said.