Yonah Bromberg Gaber | Graphics Editor

Source: University release

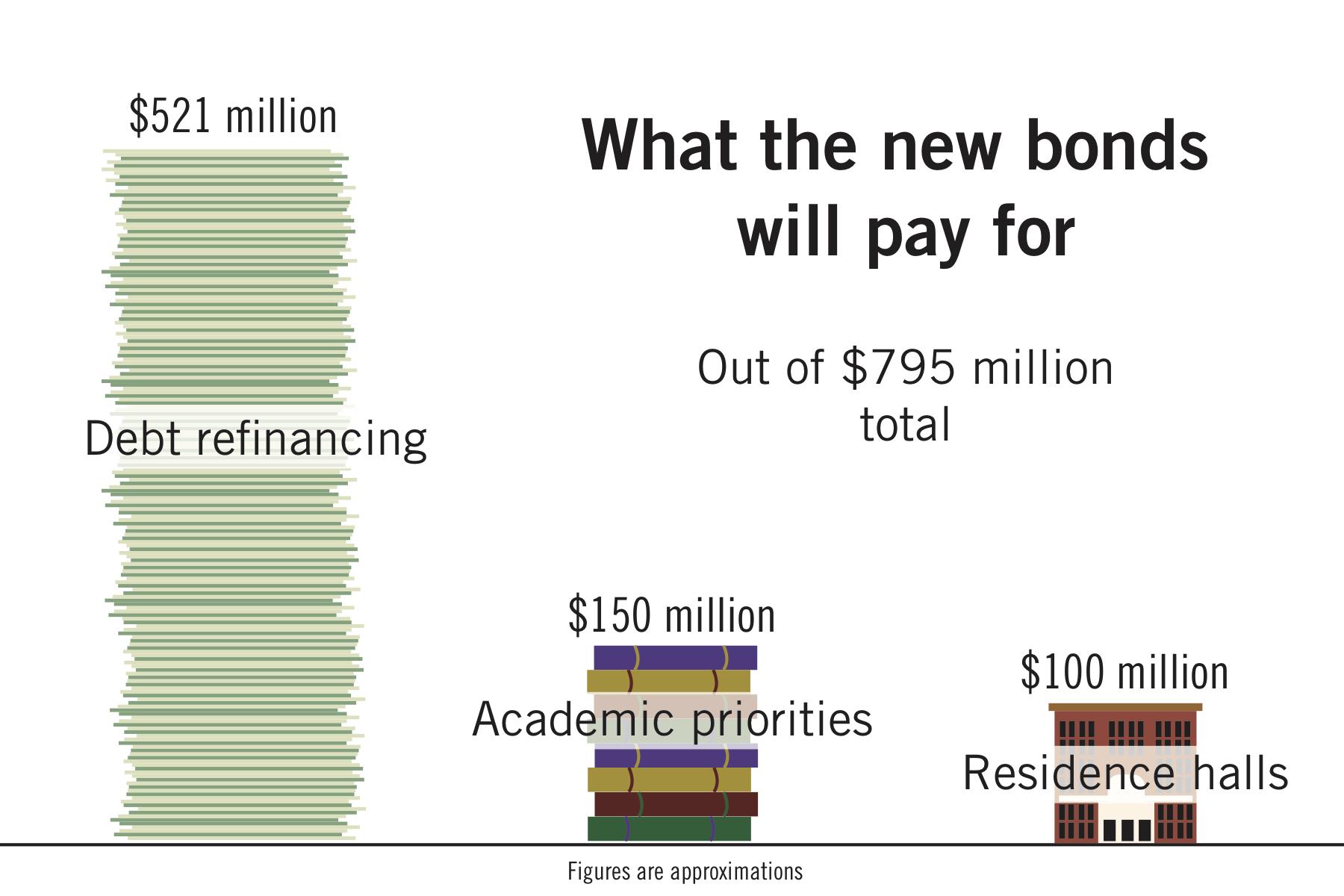

The University is laying the groundwork for major future campus projects using nearly $800 million in new bonds.

Officials plan to use the new funding, which will add $250 million in new debt, to finance a new residence hall, long-awaited renovations to Thurston Hall and unspecified “academic priorities.” Experts said taking on more debt is a risk, given the uncertain financial future of higher education, but it can pay off if the new academic and residential projects improve the University’s reputation.

University spokeswoman Lindsay Hamilton said issuing the bond will help the University save money over time through refinancing the debt, monetizing investments in real estate and investing in projects that are GW’s top priorities.

“The University has always managed its debt portfolio in a comprehensive and strategic manner, with particular focus on managing risk and cost of capital, which support the liquidity needs of the institution,” she said in an email.

To compensate for the additional debt, Hamilton said GW would rely on its real estate holdings in various properties across the District. Officials have relied on funding from GW’s ownership of major retail and commercial properties like 2200 and 2122 Pennsylvania Ave. to fund academic and construction projects. The University also plans to redevelop 2100 Penn in the coming years.

The University’s bond is expected to be paid back to investors with interest by 2048, according to the Moody’s report.

Hamilton declined to say what “academic priorities” the University would fund with the $150 million in spending from the bond.

Residence hall projects

The new bond includes $100 million earmarked for residence hall projects, including constructing a new residence hall and renovating Thurston Hall, Alicia Knight, the senior associate vice president for operations, said.

Officials have not determined an exact location for the new residence hall, but Knight said they are considering an area on the corner of 20th and H streets as a possible site. She said the University’s 20-year campus plan has already identified the area as a possible site for a new residence hall.

She said the idea for the building emerged from conversations about how to renovate Thurston – GW’s aging freshman residence hall built in 1929. Officials have said Thurston has been in need of an overhaul since 2015. They hired an outside consulting firm last fall to examine the feasibility of renovations.

“As a part of these discussions, it became evident that we would benefit from a new residence hall to both create enhanced facilities for undergraduate students and also create additional residential beds on the campus to provide flexibility for the ultimate design of a renovated Thurston,” Knight said in an email.

She said the new residence hall could allow a revamped Thurston to have fewer beds than the more than 1,100 it now houses.

Knight said the design of the new residence hall and official renovation plans for Thurston are still in the works, and official discussions on construction will begin after the Board of Trustees approves the 2019 fiscal year budget next month.

Exploiting low interest rates

Richard Vedder, the director of the Center for College Affordability and Productivity at Ohio University, said adding more debt is risky because it doesn’t leave a financial cushion if enrollment projections aren’t met.

“The assumption seems to be that the general good times for higher ed will continue,” he said. “There is a lot of concern I think that this is not necessarily going to be the case.”

The University relies on tuition revenue to fund much of its budget. Officials instituted several rounds of budget cuts after an unexpected drop in graduate enrollment in 2015 triggered a University-wide budget crunch.

Michael Volna, the assistant chief financial officer and associate vice president at the University of Minnesota, said it is typical for universities to make a major financial decision based on the most significant needs of the University. He said many times universities make investments to improve their national rankings because launching new projects can make schools more attractive to students.

“I would generally say that oftentimes to jumpstart new academic priorities, you do need to make investments in labs, in buildings,” he said.

Volna said refinancing debt while interest rates are relatively low will help the University get the best deal on existing debt, in terms of maturities and interest rates. Officials plan to refinance $521 million in existing debt using the new bond, before interest rates rise.

“It’s always important to be maximizing your liabilities when you refinance and pay off higher interest rate debt with lower interest,” he said.

Adding to the debt

The University has been on the path to financial recovery in recent years after revenues fell in 2014. Executive Vice President and Treasurer Lou Katz helped create a repayment plan for the University’s debt in 2016, focusing on using property revenue from real estate investments.

Katz said at the time that officials would launch fewer construction projects in the coming years in favor of focusing on paying down the debt. The capital budget has fallen in recent years as major projects like the Science and Engineering Hall have wrapped up.

Officials said the University pulled in a $100 million surplus last fall – the first in years. Last year, officials also paid back $160 million to reduce the debt after years of steadily rising deficits.

The last bond the University took out in 2015 was a $350 million bond, scheduled to be paid back in 2045.

Officials said taking out the additional debt now will be later offset by real estate holdings and residence hall revenues. When GW built the Science and Engineering Hall for $275 million, officials expected to pay the bond back with donations, but ended up using revenue streams from the University’s ownership of The Avenue complex on I Street.

Anthony Yezer, a professor of economics, said that because of the concern that interest rates will continue to rise, it’s safer for the University to refinance the debt sooner rather than later. But he said residence hall renovations were not obvious priorities for the University.

“I did not know we needed more dorm rooms or that redoing Thurston was such an immediate priority,” he said in an email. “Again, we could be accelerating this because of the fear of rising interest rates.”